capital gains tax changes uk

The following Capital Gains Tax rates apply. Posted a day ago by Phoebe Lau.

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

If people are currently renting out their former home and are considering selling the.

. Tell HMRC about Capital Gains. Up to 5 April 2020 the gain was reported on a Non Resident Capital Gains Tax returnFrom 6 April 2020 relevant gains are reported via the Capital Gains Tax on UK property service. Tax when you sell property.

The changes in tax rates could be as follows. The UK government introduced non-resident capital gains tax NRCGT which applies to all non-UK residents including individuals trusts and companies. 10 and 20 tax rates for individuals not including residential property and carried interest.

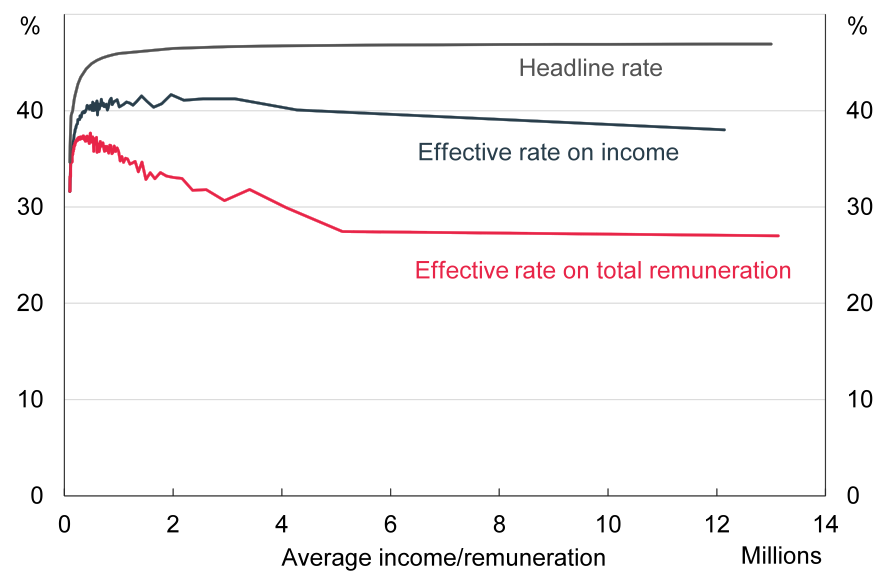

If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners. This could result in a significant increase in CGT rates if this recommendation is implemented. The same change will also apply for non-UK residents disposing of property.

From 6 th of April. On 20 July 2022 the government set out proposals to relax the capital gains tax rules when married couples and civil partners separate or divorce. From 6 th of April.

On 6th April 2020 the new rules come into force concerning the. From 6 April 2020 new capital gains tax CGT rules will apply to disposals of UK private residence property for UK residents. The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income tax according to a recent report.

The UK government introduced non-resident capital gains tax NRCGT which applies to all non-UK residents including individuals trusts and companies. The government has said it will consult on expanding this rule to cover the enhancing of land thats already owned and isnt currently covered by the current rules. Thanks to our friend Peter Vaines of Field Court Tax Chambers for this significant update on UK capital gains tax.

Basic rate taxpayers would also see bills increase from 18 to 20. Published on 5 October 2022. Work out tax relief when you sell your home.

Tax when you sell your home. Changes to capital gains tax on UK property. Proposed changes to Capital Gains Tax.

Capital Gain Tax. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. It is only payable on the disposal of certain chargeable assets including personal possessions worth 6000 or more property that is not your main home shares and business.

Any gain over that amount is taxed at what. Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020.

If CGT and Income Tax rates become more closely aligned the government could also consider. If there was realized loss in 2020-2021 can it be used. 18 and 28 tax rates for individuals.

The additional tax falling due on the gain of 47500 could therefore be an extra 13300. I come from HK and have been residing in UK since end of Aug 2021. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due.

Tax if you live abroad and sell your UK home.

Capital Gains Tax Low Incomes Tax Reform Group

Change In Non Resident Capital Gains Tax Rules For Sale Of Uk Residential Property

Capital Gains Tax Is Not A Raid On The Mass Ranks Of The Middle Class

New Exemption For Capital Gains Obtained By Non Residentsavantges

Crypto Tax Uk Ultimate Guide 2022 Koinly

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Crypto Tax Uk Ultimate Guide 2022 Koinly

Getting Ready For Uk Capital Gains Tax Changes Aam Advisory

Capital Gains Tax Changes That Self Assessment Customers Need To Know About Hm Revenue Customs Hmrc

Rishi Sunak Shelves Proposal To Hike Capital Gains Tax Pointing To Burden The Independent

Property Owners Must Prepare For Changes To Capital Gains Tax Reporting On Residential Properties Bdaily

Proposals To Increase Capital Gains Tax In Uk Could Make Guernsey An Even More Attractive Relocation Proposition Swoffers

Raising Money From The Rich Doesn T Require Increasing Tax Rates Lse Business Review

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

Capital Gains Tax In The United States Wikipedia

The Complete Guide To The Uk Tax System Expatica

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)